11/17/2022

Brazil’s financial newspaper Valor released their review of A Banker’s Journey where they state “the book is essential for anyone who wants to learn more about one of the most important bankers of the last century globally speaking.”

For those who can read Portuguese, the original article can be found on their website.

For those who cannot, we have an English translation below:

Edmond Safra founded and controlled banks in four countries in three continents and, during this trajectory, he used principles that go against the stereotyped image of bankers. His main base was a network of contacts formed mainly by family members or members of the Jewish community or by people originating from the same region where he was born, in Syria. Gradually, this chain of contacts expanded, but he did not leave these first “allies” aside.

Edmond used to say that you should only give loans to people that the banker or his employees knew well, looking the borrower in the eye. He did not follow the “modern” model of granting financing based on mathematical formulas or algorithms. When one of his banks lost money because a customer defaulted, Edmond would ask his employees, “Did you look into the eyes of the person [when granting the loan]? Did you sit across from each other? How do you lend money to a person if you don’t know them at all?”

He also defended “the rights” of his banks’ customers – it was better that he, Edmond, lost money than those who had trusted his financial institution. In one of the few times he gave an interview, in this case to the “Financial Times,” he said, “A banker’s duty is to protect what his customers have entrusted to him. He receives the client’s confidences, sometimes he is a friend. He is the guardian of people’s secrets. And our clients show their trust by giving us their money. We invest with caution because it’s not our money.

Edmond did not hide that he had his superstitions. He always carried an amulet with a blue eye, to ward off evil. When he was negotiating the sale of his banks (to HSBC), he wanted the price to be $72 per share for one simple reason: 72 had a special meaning to him because it corresponded to 4 times 18, the numerical value of the Hebrew word “chai”, which means life.

Another fundamental principle in his life and in his role as a banker was philanthropy. Throughout a little more than five decades of work (he started at the age of 16, in the service of his father), he helped hundreds of people migrating from conflict regions, such as Syria itself, or finding jobs, often in his banks, repeating, in a way, the history of his own family, who had to move countries several times until they found refuge in Brazil.

Little was known about the life and even the commanding style of Edmond Safra, who throughout his life very rarely spoke to the press and, despite the fortune he amassed, maintained a standard of exceptional discretion. It is curious, therefore, that many of the “secrets” about him are being revealed in a book that had more than the help of his family, mainly his widow, Lily Safra (who passed away this year), and the foundation that bears his name. In fact, the work came from their initiative. After his death in 1999, the Edmond J. Safra Foundation promoted interviews with friends, religious people with whom he lived, directors of the banks he founded, other bankers, professors and family members about what Edmond thought and how he acted (in this text, I’ll call him by his first name to avoid confusion with other Safras, such as his brothers, Joseph and Moise).

In addition, Edmond kept for decades an archive of documents – letters, plane tickets, calendars, financial reports, travel itineraries, newspaper clippings, analysts’ reports, etc. – in Arabic, Hebrew, Portuguese, Italian, French, German, Spanish and English (the banker was fluent in six of these languages).

All this material plus the interviews were passed on to journalist and writer Daniel Gross by Lily Safra in 2017. She told him that “someone had to tell the story,” as Gross recounted in a talk hosted by the Harvard Book Store on October 21st.

Descended from a family of Syrian Jews, as are the Safra’s, Gross has a long career writing about finance and business. He has worked at Bloomberg, “The New York Times,” and “Newsweek,” among others, and has written eight books on economics, having studied at Cornell and Harvard Universities. The fact that one of his ancestors was born in the same hometown as the Safra family, Aleppo, helped Gross to be invited to write the book and also to better understand Edmond’s motivations and yearnings.

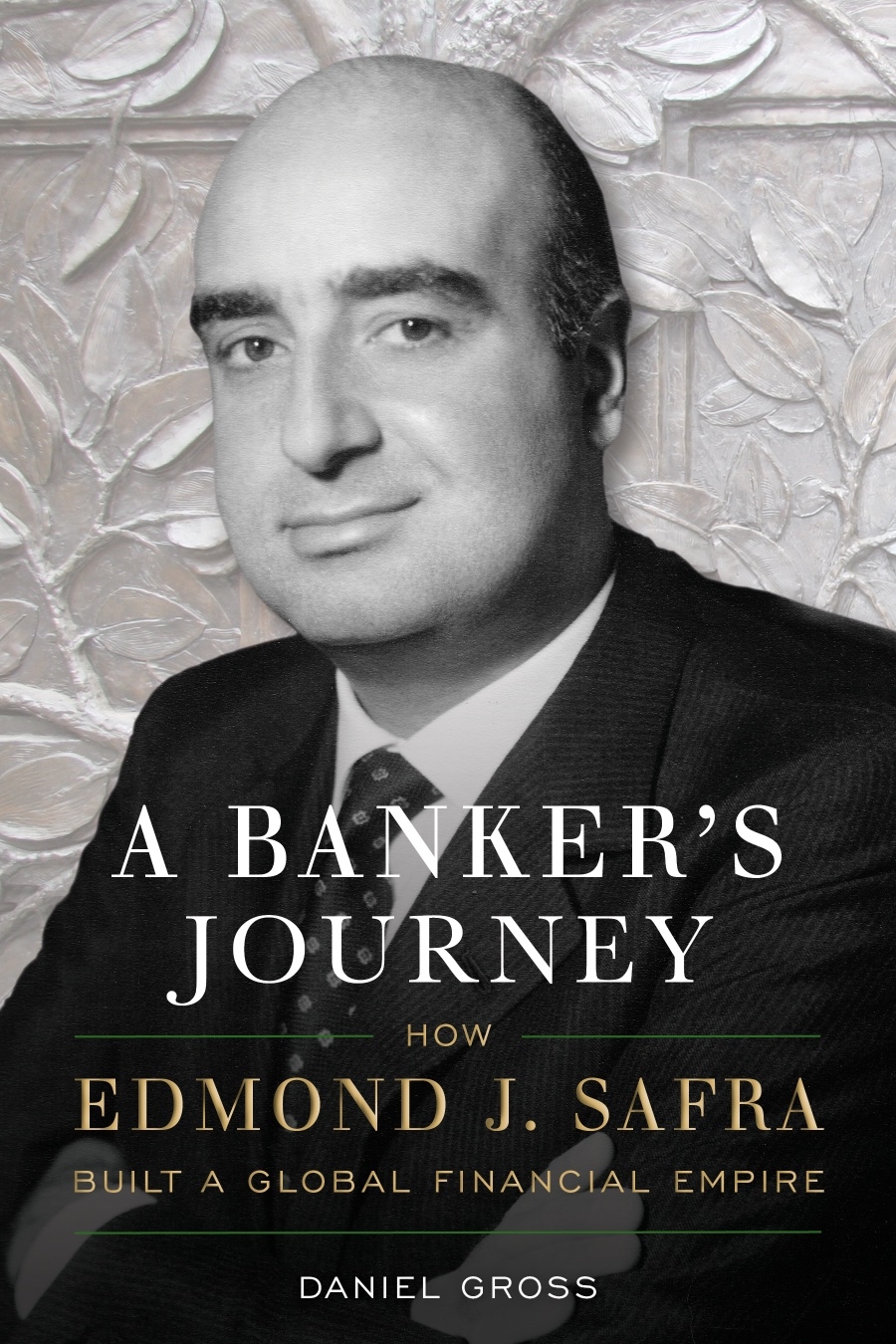

The work resulting from the research and the archive – “A Banker’s Journey: How Edmond J. Safra Built a Global Financial Empire” – is true to its title. Edmond did indeed found and control a banking powerhouse: two of his banks, Republic National Bank of New York and Safra Republic Bank, both headquartered in the United States, were sold to HSBC for $10 billion in 1999.

Brazil played an important role in Edmond’s life and professional growth – and that of other members of the family, including his father Jacob, who died in São Paulo. It was here, in 1954, that they gained citizenship and found a place to live and to develop their business after leaving Syria and passing through Europe. At the beginning of his life in Brazil, Edmond did not work with finance – he even took out a Brazilian work card that identified him as a merchant, which he indeed was for a while, initially exporting cotton and importing, a little later, machinery and chemical products.

With the wealth of material ceded to him by the foundation created by Edmond, plus his own research, Gross draws a hitherto unpublished portrait of the banker. To Valor, by e-mail, he answered if he calculated how much Edmond donated. When he died, in 1999, he had about US$ 3 billion from the sale of American banks, besides real estate, works of art and other investments which were worth a lot. In his will, he left provisions for Lily and her family and for his sisters. Much of his estate went to the Edmond J. Safra Philanthropic Foundation, based in Geneva. “Half of what he got from the banks would be about $1.5 billion. That was in 1999. In the following years, the funds were invested conservatively. I think they must have appreciated in value. The Foundation must operate in perpetuity – which means that it spends a small portion of its assets each year. If I had to guess how much he spent on philanthropy, I’d say it was hundreds of millions of dollars, but I have no documents on that.”

Edmond also faced, of course, gigantic problems, one of them the smear campaign waged in the late 1980s by leaders of American Express, which had shortly before bought the Geneva-based Trade Development Bank from Edmond himself. Later, the president of American Express himself apologized to Edmond for spreading lies and paid compensation of $8 million to philanthropic institutions that he had appointed.

The end of Edmond’s life was marked by disagreements and tragedy. Gross recalls a communiqué issued by Republic in 1998 about his diagnosis of Parkinson’s disease and about how the succession in the banks would be in the event of his illness and death: it is explicit in the official note that his brother Joseph, then 60 years old, would have an important role in conducting Edmond’s business. “In fact, Joseph is reorganizing his schedule to make it possible for him to commit even more time to help me manage Republic New York Co and Safra Republic.” This ended up not happening. Joseph continued to focus on Safra Bank in Brazil and other businesses. According to Gross, the conditions he had imposed to assume more responsibilities in the American banks were not met. Edmond eventually decided to sell both financial institutions.

The greatest tragedy was, of course, Edmond’s death in late 1999, in his apartment in Monte Carlo, caused by one of his caretakers who, in search of greater recognition and a better salary, pretended that the residence had been invaded by bandits and set fire to the apartment. Edmond and a nurse died suffocated by the smoke.

The book is clearly partial to Edmond in the sense that his benevolent actions are treated in a complimentary manner and Gross does not hide his admiration for the banker. It is not only he who acknowledges Edmond’s achievements – the book’s introduction features the testimony of very diverse personalities such as Michael Bloomberg, who stresses Edmond’s “sense of responsibility to others,” and actor Michael J. Fox, who has suffered from Parkinson’s disease for many years, the same disease that blighted the last years of Edmond’s life.

Despite this favorable tone to the banker, the book is essential for anyone who wants to learn more about one of the most important bankers of the last century globally speaking.